Employment-related lawsuits have been on the rise, creating significant challenges for businesses. Here are some key insights and trends:

Increase in Lawsuits: Employment-related lawsuits have grown substantially in recent years. For instance, labor and employment class action claims have been on the rise. This trend highlights the increasing legal risks businesses face.

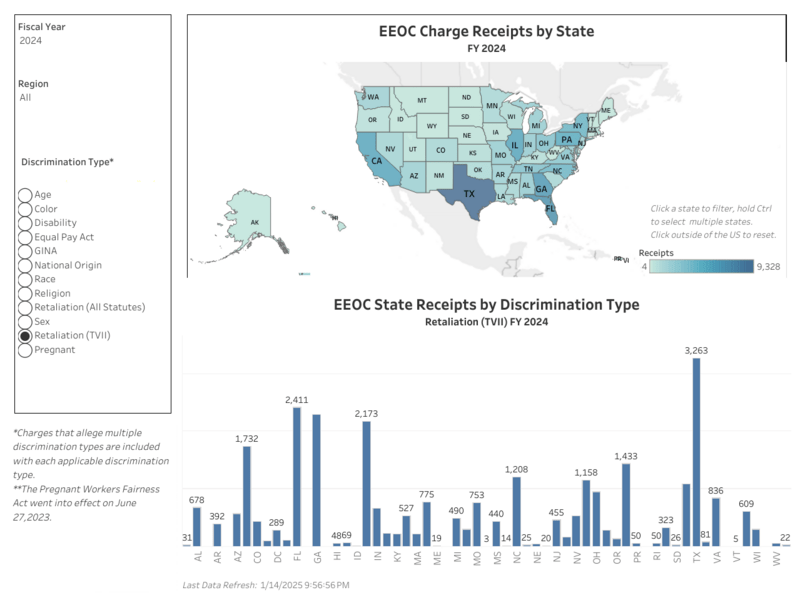

Common Claims: The most frequent claims include wrongful termination, discrimination, and retaliation. Retaliation claims alone made up over half of the Equal Employment Opportunity Commission (EEOC) claims.

Pay Transparency: New laws in states like California and Washington require employers to disclose salary ranges in job postings, aiming to address pay equity.

AI in the Workplace: Legal frameworks are evolving to regulate the use of AI in hiring and performance evaluations, ensuring compliance with anti-discrimination laws.

Independent Contractors: Worker classification remains a contentious issue, with evolving regulations impacting businesses.

Financial Impact: The cost of defending labor and employment class actions has surged, with such cases causing legal expenses for businesses to rise.

These trends underscore the importance of Employment Practices Liability coverage as a safeguard for businesses. EPLI can help cover legal fees, settlements, and judgments, providing critical protection against the financial risks of employment-related claims.

An Employment Practices Liability Insurance (EPLI) policy covers legal defense costs, settlements, and judgments, which can add up quickly and significantly impact your bottom line. EPLI also helps you maintain a positive workplace culture by providing resources for risk management and compliance.

Employment Practices Liability Insurance (EPLI) typically provides protection for businesses against claims related to employment practices. This often includes:

Discrimination: Claims of unfair treatment based on factors like race, gender, age, religion, or disability. Discrimination claims accounted for approximately 35% of all charges filed with the EEOC in 2024.*

Harassment: Protection against allegations of workplace harassment, including sexual harassment. Workplace harassment claims, including sexual harassment, represented around 25% of EPLI claims in 2024, showing a steady increase due to heightened awareness.*

Wrongful Termination: Coverage for claims where an employee alleges that they were unfairly or unlawfully fired. Wrongful termination claims made up nearly 20% of EPLI claims in 2024, remaining a common cause of employment-related lawsuits.*

Retaliation: Claims involving retaliation against employees for whistleblowing or filing complaints. Retaliation claims surged to over 55% of all EEOC charges filed in 2024, highlighting the importance of anti-retaliation policies.*

Breach of Employment Contract: Allegations of violating the terms of an employment agreement. Breach of employment contract claims were less frequent, accounting for approximately 10% of EPLI claims in 2024.*

Failure to Promote or Hire: Claims of unfair hiring or promotion practices. Claims related to unfair hiring or promotion practices constituted about 15% of EPLI claims in 2024, with increased scrutiny on AI-driven recruitment processes.*

Bosworth & Associated can tailor EPLI to fit the specific needs of your business.

What does EPLI cover? It typically covers claims related to discrimination, wrongful termination, harassment (including sexual harassment), retaliation, and other employment-related issues.

Why is it important for small businesses? Small businesses are often at risk because they may lack formal HR policies or resources to handle legal claims. EPLI helps cover defense costs, which can be significant even for groundless claims.

What are the costs involved? The cost of EPLI varies depending on the size of the business, the number of employees, and the level of coverage. Defense costs and settlements can be substantial, making EPLI a valuable investment.

How does it differ from other business insurance? Unlike general liability or workers’ compensation insurance, EPLI specifically addresses claims made by employees against their employer.

Ready to Protect Your Business?

Get a Free EPLI Consultation and Quote

Speak with a local EPLI expert today! Call 903-561-2621

* https://www.eeoc.gov/newsroom/eeoc-publishes-annual-performance-and-general-counsel-reports-fiscal-year-2024